The Central Bank of Nigeria (CBN) has revealed a significant upswing in Diaspora remittances, reporting a remarkable 433% increase to $1.3 billion in February from $300 million in January.

Mrs. Hakama Sidi Ali, the Acting Director of Corporate Communications at the CBN, disclosed this development during a press briefing in Abuja. According to her, the surge in remittances reflects a robust inflow of funds from Nigerians living abroad, marking a substantial boost to the country’s foreign exchange reserves.

Ali explained, “The Bank’s data indicates that overseas remittances rose to US$1.3 billion in February 2024, more than four times the US$300 million received in January.”

She further highlighted that foreign investors demonstrated a keen interest in Nigerian assets, with purchases exceeding $1 billion last month. The total portfolio flows recorded in 2024 stand at least US$2.3 billion, compared to US$3.9 billion in total for the previous year.

The trend of higher foreign exchange (FX) inflows has persisted into March 2024, driven by increased investor appetite for short-term sovereign debt. Ali noted that government securities issuances have been oversubscribed significantly, with foreign investors contributing over 75% of the total bids received at auctions conducted on March 1 and 6, 2024.

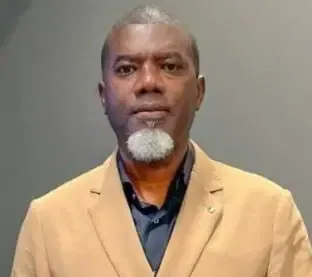

The recent surge in remittances and foreign investment aligns with the CBN’s efforts to implement strategies aimed at curbing inflation, stabilizing the exchange rate, and fostering confidence in the banking system and economy. Governor Olayemi Cardoso, during the last Monetary Policy Committee meeting and a conference call with foreign portfolio investors, outlined a detailed plan to bolster Nigeria’s foreign currency reserves and enhance liquidity in the foreign exchange market.

Governor Cardoso emphasized, “All the different measures we have taken to boost reserves and create more liquidity in the markets have started to pay off. When people understand the real issues and see a strategy and a plan, things tend to calm down. Our objective today is to ensure that the market has supply, that the market functions, and that investors can come in and go out.”